Customer Lifetime value (CLTV)

What is customer lifetime value?

Customer lifetime value (CLTV) is an assessment of how much each new customer is likely to pay you over the course of their relationship with your company or service. While each customer will differ based on their requirements and their use case, this value should be done in aggregate to provide the value of the average customer.

A quick example would be if the average customer for Netflix (or another streaming service) is likely to stay subscribed for 3 years to the basic plan, their lifetime value would be $8.99 x 12 months x 3 years = $323.64.*

*These numbers are purely hypothetical.

Why is it important?

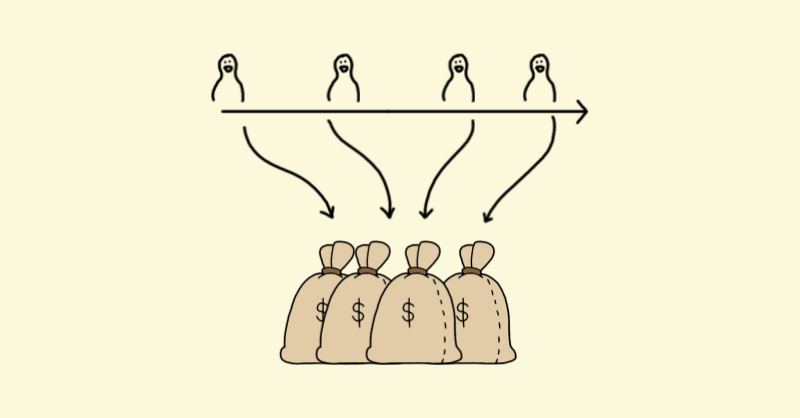

The CLTV will play a part in defining the maximum amount you can pay to acquire a new customer. This means it will be easier to plan and analyse any marketing or sales costs to ensure that the company remains profitable for each unit that it sells.

Continuing the example of Netflix (or another streaming service). If it costs $1 per month to provide the service to a new user, that means that the total cost of providing the service over the 3 years, would be $1 x 12 months x 3 years = $36. With that, we know that in order for the company to remain profitable, it must not cost more than $323.64 - $36 = $287.64 to get a new customer subscribed to the streaming service.

This then allows Netflix (or another streaming service) to know that to make no money, the maximum they can pay for advertising, influencer marketing, or the like to get 1 more user on average is $287.64. Thus, in order to ensure they make money, they would have to pay less than $287.64.*

*Again, these numbers are all hypothetical.

Types of customer lifetime value for different business models

Different business models have different ways to consider the CLTV. However, the basic premise remains the same: how much will each new customer pay the company over the span of their entire brand relationship. Ideally, you want them to: 1. Pay you often, 2. Pay you more, or 3. Pay you for a longer period of time.

Subscription

The CLTV for a subscription model is much easier to consider when calculating CLTV so we will start by explaining CLTV for a subscription model. In the above example of the streaming service, we already gave a good idea of how to calculate CLTV. In this section, we will go through how to get the various numbers in order to calculate the CLTV.

The basic concept to calculate CLTV is to get the percentage of people who discontinue the service over the billing period (Churn) and multiply it by the average amount of money they are paying during that period.

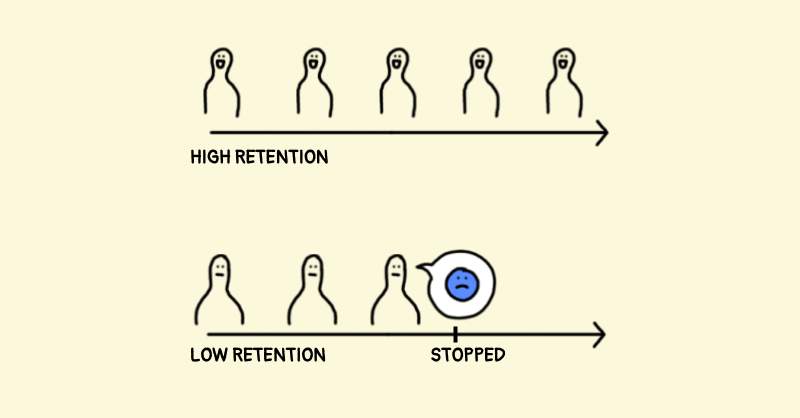

Customer churn

In order to get the customer churn, the simplest method is to take a batch of people who signed up at around the same time and, over 1 billing period, track the percentage of people in that batch who decide to discontinue the service. This will be your churn over the billing period.

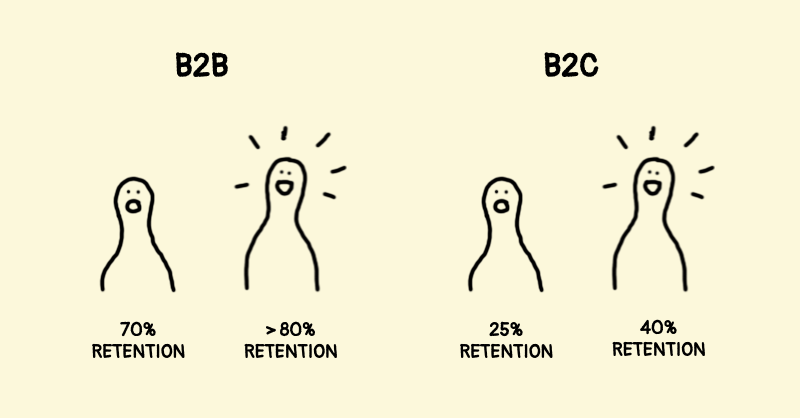

Use more batches to further increase the accuracy of your churn percentage. Some good benchmarks for B2C products are 25% being “doing ok” and 40% being a great rate, while for B2B products, a 70% rate is alright and any rate above 80% is great.

Lifetime value of the subscription model

Next in order to get the lifetime value, take 1 divided by the churn percentage. This will give you the estimated average number of billing periods each person would use your subscription before discontinuing the service.

You then multiply this number of billing periods by your price per billing period and you would get the average CLTV of the subscription.

Single payment purchase

The CLTV for a single payment purchase can be slightly more complicated as it needs you to understand how often someone will repurchase the item from your brand or store. In the absence of your own historical shopper data, the next best could be by understanding the benchmarks of the industry your store is in.

Repurchase rate

If you do have historical data, you can use your existing repurchase rate to calculate the probability of a new customer repurchasing from your store. This factor will be affected by how often you are able to retrigger a previous customer to make a similar purchase or a complementary purchase.

For single payment purchases, this is a worthwhile metric to consider investing in as studies by ecommerce brands have shown that it is much cheaper and more profitable to get an existing customer to a repurchase over a new sale.

Customer lifetime value

Now that you have your repurchase rate, this works similar to the churn. You would take 1 divided by the percentage of non-repurchases. Then multiply that by the average amount the customer purchases from you. This equation will then give you the average lifetime value of each customer.

An example is if you sell Netflix (or some other streaming service) merchandise. The customer, on average, will purchase $40 of limited edition merch from you. Out of 100 customers, an average of 10 people will come back to buy another $40 of merch for their fellow fan. This means the repurchase is 10% and the percentage of non-repurchase is 90%.

You can then add that to the equation, (1 / 0.9 ) x $40 = $44.44. Each customer for your shop would thus be worth $44.44 of revenue.

Final thoughts about CLTV

In conclusion, it is important to think in terms of CLTV instead of absolute revenue each customer brings on the surface as it will ensure you focus on increasing retention instead of just sales.

2 takeaways to implement

Track your customer lifetime or repurchase rate

If you are not already doing so, track each of the components of your CLTV:

- What is your retention rate?

- What is the average price / basket size your customers are paying for?

Then, check if there are any low hanging fruits to increase either the basket size/ price or your retention rate.

Calculate your customer lifetime value

If you are not already doing so, calculate your CLTV. Is your CLTV more than expected or less than expected?

Can you do more in order to acquire more customers at your current CLTV/ at a lower CLTV profit margin? Would the additional volume be more beneficial or less so for your entire business?

That's all for this week's issue of Startup Illustrated. I hope this helped you in some way or form. If you'd like to have the next issue of Startup Illustrated delivered to your inbox, do subscribe to our newsletter. You can also follow the Startup Illustrated Twitter account @StartupIllustr. If you'd just like to say hi, just drop me a DM on Twitter @foundbryan.Until next week, I wish you all the best!