Basic concepts to know when deciding on funding

So... how should I fund my startup and how does it work?

This should be a simple question. However, without a full understanding of the pros and cons of how funding works and the strengths of finding investment and self-funding, this can be a difficult topic to broach.

First, let us get the elephant out of the room. There is no such thing as no funding. When you start a business, you will either be self-funded or finding investment. This is because when you start a business, money is necessary. Even if you are doing all the work, you need to account for the cost of your own time and labor.

Now that that is out of the way, we will first breakdown the general overarching pros and cons of finding investment vs self-funding. After that, we will dive into the strengths and weaknesses of the individual methods.

Contents of this article

- Introduction (Before this)

- Self-funding vs finding-investment

- Dive into self-funding

- Pros and cons of side hustling

- Pros and cons of full-time bootstrapping

- Dive into finding investment

- What does giving up a part of your company mean?

- Explaining funding rounds

- Pros and cons of finding investment

- A note on hybrid investment

- Conclusion: What type of founder are you and what business are you building?

Self-funding vs Finding investment

The main differences between self-funding and investment will be:

- The amount of money you will have available to turbocharge your company

- Accountability to others ( and its effects on your autonomy )

1. Amount of money you have available to you

Money is to a business like food is to a person.

With limited money, your business will soon starve. With money, your business has more options available for it to grow (e.g. advertising, influencer marketing, hiring more people... ).

It is great if you have a plan on how to effectively spend the money, however, it is just as easy to squander the money or scale up your business too early which will have the reverse effect.

On top of that, once you receive investment and are using Other People’s Money (OPM), it will lead to you also having….

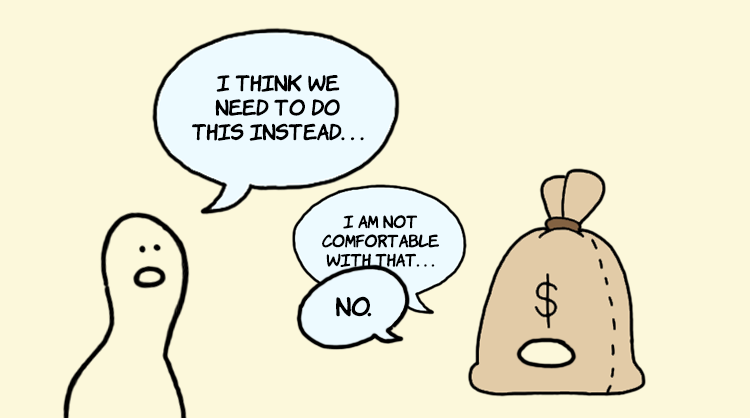

2. Accountability to others

The second main difference is that you will now be accountable to your investors about how you are spending their money.

Note: Not all investors will be like this. If you do take investment, find investors who believe in you and trust your decisions.

The fundamental truth is when people invest their money, they expect to get it back and more. Even investors who put money into currently non-profitable companies are expecting a return on whatever they have put in. They are just willing to bet bigger and wait a longer time for it in return for a massive profit if they succeed.

So unless it is a donation, any investor will want to be kept up-to-date on how you are using the money and also have a say in how the money is being spent. This might mean not being able to pursue certain strategies you’d like as well as having to explain to your investors the logic behind other decisions. When you self-fund, you will only need to be accountable to the owner of the money - you.

These two points should be food for thought when either finding investment or self-funding. Let us now deep dive into the mechanics of the more straightforward method: self-funding.

Saying no to finding investment: Diving into Self-funding

Self-funding is more straightforward. You own all of the company and you make all the decisions.

This is the most flexible method as you can easily switch between the two methods of self-funding depending on your own priorities at that point of time. Also, note that it is easier to move from being self-funded to finding investment, compared to from invested back to being self-funded.

Self-funding generally comes in two methods which have their own pros and cons: Side hustling or bootstrapping.

Side hustling

Side hustling is essentially when you do your business / startup part-time while holding onto a day job which pays you a salary.

When choosing to do it part-time, as someone who has experienced it before, you would need to be disciplined (i.e. waking up early) or be prepared to use the time which would be normally used on decompressing (i.e. working on the business after work) in order to make any progress at all.

Also, take note that if you choose to pursue the side hustle method, you have to be prepared that things will not progress as quickly as you hope since you won’t be able to consistently and sustainably devote large swathes of time to your side hustle every week.

Pros:

- Certainty of having a stable salary

- Less risk

- Can be done indefinitely

Cons:

- Having to juggle a day job and side project

- Probably slower pace of work

- Less focus - it is very possible both your career and side hustle doesn’t grow

Let’s say you don’t want to side hustle but still want to self-fund. That is when you go into...

Bootstrapping

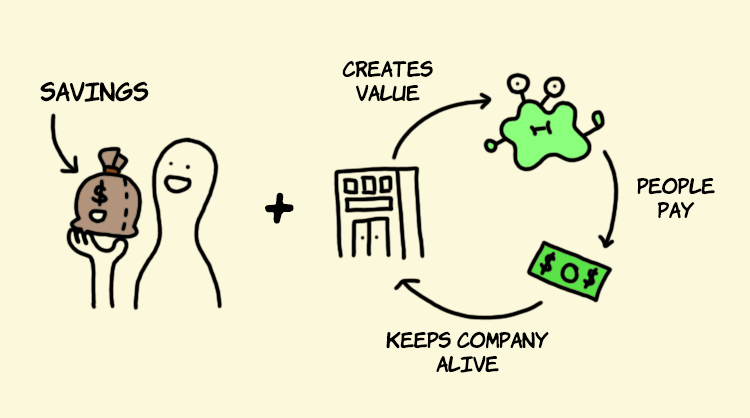

Bootstrapping is when you self-fund your venture from savings and revenue from sales. If you plan on being a bootstrapped company, revenue numbers, profitability, and monetization models are going to be your best friend. This is as you are going to need to get money coming in as soon as you can.

Your first aim will be to get to Ramen Profitability before your savings run out. This term coined by Paul Graham means that your business now generates enough profits to support the founders’ living expenses.

Pros:

- Focused

- More time to work on your business

Cons:

- Depletes personal savings

- Fixed deadline of achieving success

Now that we have gone through both types of self-funding, a quick note is that because you own 100% of the company, it is easy to transition between methods - so if your savings does run out, you can easily transition the company into being a side hustle in order to keep it alive and vice versa if your side hustle has become Ramen Profitable.

Now if you decide that the self-funding life is not the route you want to take, you can find yourself...

Saying yes to finding investment: Diving into finding funding

This is where the concepts get slightly more complicated.

Since you are now bringing in a third-party, some baseline knowledge of how companies work is necessary to build upon and understand how investing in startups work.

So, let’s talk about the first principles:

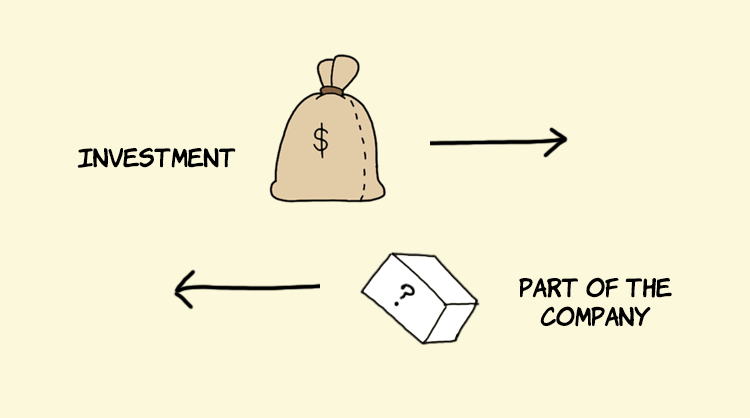

Getting investment is a transaction. People are giving you money and you will be giving them part of the company.

This leads to the question:

What does giving a part of your company even mean?

To answer this question, we need to understand what a company is in the eyes of the legal system.

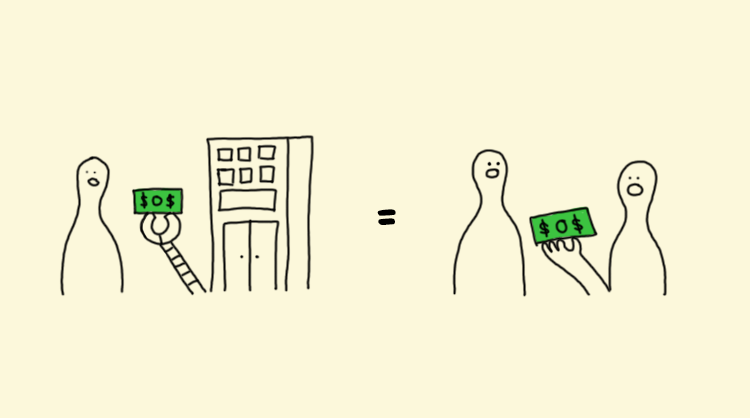

A company is considered a separate legal entity separate from the founders. This means that it treats the company like another person/ individual.

If a company gives you money, it is equivalent to another person giving you money.

The company is then able to give up parts of itself to others to own. The company is able to determine the absolute number of parts of itself that is available for other people to own. These are its “shares”.

For illustration purposes, let’s say your company determines that there are a total of 80 parts of itself and gives it to you in exchange for your time and effort (a.k.a. Sweat equity). You will now own 80 out of 80 parts of the company - 100% of it.

So, what happens when you take funding?

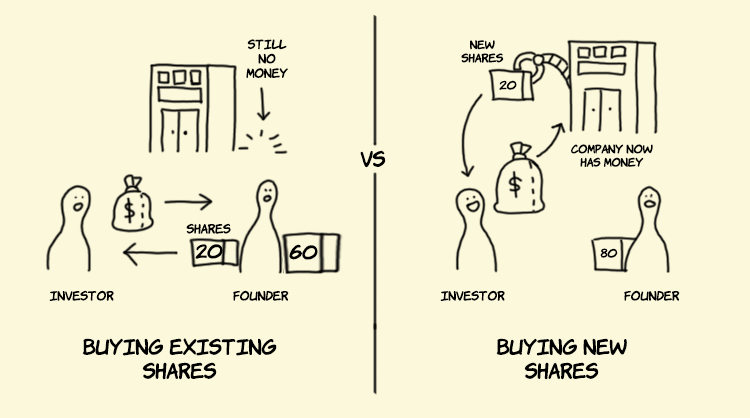

Back to how the transaction works, when people want to invest in your company, they want the company to get the money and for themselves to get a few parts of the company.

In order to fulfill both parts of the transaction, the company will need to sell parts of itself to the investor in exchange for money. In order to do so, it will need to create more shares to sell.

The investor cannot just buy the existing shares from the founder because then the money would go to the founder instead of the company.

Continuing the example, let’s say your company now determines that there are a total of 100 parts of itself. Since originally there were only 80 parts, it has created 20 more parts. It can then sell these 20 parts to the investors in exchange for money.

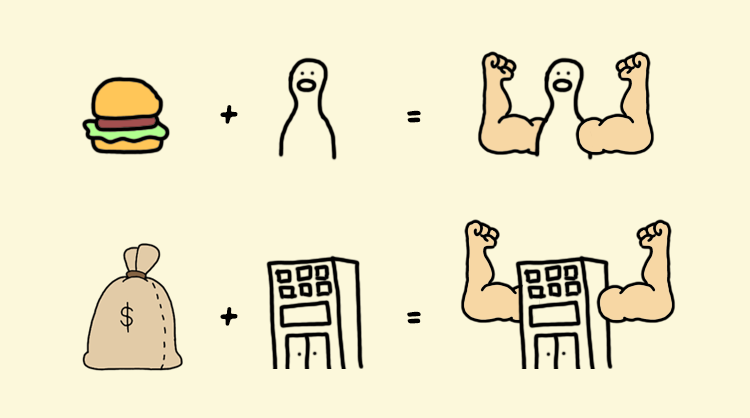

Now, the situation is that you own 80 out of the 100 parts - 80% of the company, the investor owns 20 out of the 100 parts - 20% of the company, and the company now has the invested money it can use to grow. This drop in the percentage of the company you own is called “Dilution”.

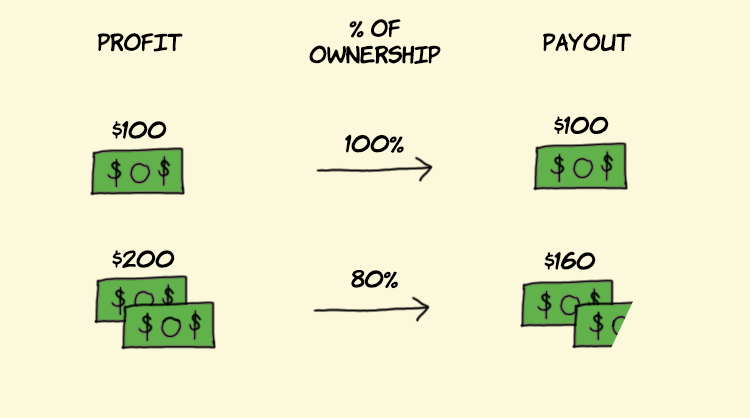

While this can seem bad for you as a founder, as you now own a smaller part of the company, the company now has more money to grow and become bigger.

If giving up 20% of the company allows you the company to bring in double the profit, the 80% you own of the bigger company is worth a lot more than 100% of the company before the investment.

Now that we’ve built up the basic understanding of how investment in businesses work, we can get into...

Explaining funding rounds

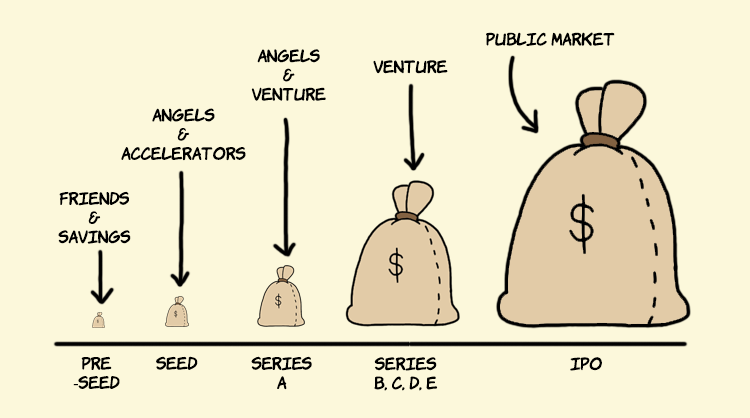

Funding can be briefly split into several rounds. They are Pre-seed, Seed, Series A, B, C, D, E … and the coveted IPO.

For each of the rounds, the amount of funding you receive and the expectations of what your company has achieved differ. The expectations increase the later series you are fund-raising for but the amount invested in your company also increases in tandem.

The expectations and the rounds can be generally split into the following types:

- Pre-seed: An idea - usually funded by your own money, friends, or incubators

- Seed: An MVP and possibly some form of traction - funded by accelerators, angel investors

- Series A: A working product, traction, a team, and more - funded by angel investors and venture capital

- Series B, C, D, E: A proven business which want to scale and grow faster - funded by venture capital

- IPO: All the legal and financial proceedings - funded by the public market

Now a question you might have is...

Why are IPOs the final level of funding?

This is because the loss of control that the founder has from giving up the same amount of shares is less when selling to the public market compared to if they raise another round of investment from one or two VCs. This is especially so at the amount raised by a company which is at an IPO ready stage.

At the same time, IPOs open up new routes of future funding for the company.

Overall, as a source of funding for a startup approaching maturity, an IPO is an attractive option.

Pros and Cons of finding investment

Pros:

- More money for growth and hiring

- More certainty of knowing where the next paycheck is coming from

- A larger network as the VCs can connect you to others

Cons:

- Less control over your company

- Growth at all costs

- Less flexibility of future funding sources (it is difficult to switch back to self-funding)

- Raising capital takes time and energy away from actually building your business

A note on hybrid investment

Recently, there have been some hybrid funding models developing where some firms invest in companies where the aim is not the next level of funding but instead on the long-term profitability of the business.

However, these firms may be few and far between. If you know of one, you can consider this model as a possibility as well.

Before we go into our conclusion, if you've found this article useful so far, consider subscribing to our newsletter to get similar articles sent to your inbox weekly!

Conclusion: What type of founder are you and what business are you building?

There is a time and place for each different type of funding. It really depends on the different needs of the founders and your business.

For example, a business which needs critical mass before becoming profitable (e.g. Uber, AirBnB - two-sided marketplaces / Facebook, Instagram - Social networks) will more likely than not need to go via the funding route.

At the same time, businesses selling Software-as-a-Service (e.g. Mailchimp, Basecamp etc.) have the option of choosing to go down the self-funded route all the way to $700 million in revenue and beyond.

I hope this helped you in some way or form. If you'd like to have the next issue of Startup Illustrated delivered to your inbox, do subscribe to our newsletter. If you'd just like to say hi, just drop me a DM on Twitter @foundbryan.

Until next week, I wish you all the best!